How To Register Llp Online Malaysia

To set up a Limited Liability Partnership (LLP) or Perkongsian Liabiliti Terhad (PLT)

SSM KL Sentral Level 17

SSM KL Sentral Level 17

*This is for not-fellow member of Professional Body

*More than info of LLP on SSM Website

MyLLP Portal Registration

Hither'due south a complete MyLLP Portal Registration User Guide for more details.

- Annals a new business relationship on myllp.com.my by clicking "Sign Up". Register as "Verified User" who tin perform more tasks. A "Full general User" tin can only log a complaint and perform name availability search.

- In one case you've successfully registered on the system, you will receive a Registration Notification email which has to be printed out.

- Bring the printed email and original IC to the SSM Part at KL Sentral to get your account verified. Take the lift to Level 17

- Take your number and look for your turn. Pass the email you printed and your IC to the person at the counter to verify your registration.

- Then you will receive an electronic mail that says your account has been activated. Utilize the same login and password y'all entered during registration.

LLP Registration

- Login to MyLLP. Click on "Check LLP Name Availability" – To check if the name you want for your LLP has been taken or non.

- Become to "Eastward-Forms" -> "Register LLP". Click on the Direct Registration checkbox and Continue if you lot have not reserved LLP Name (which is optional)

(1) Enter your LLP proper name. The organization will add together PLT later the name (example: Sunshine Service PLT)

(ii) Enter Your LLP Details (Address can be your concrete/ virtual office, abode, PO Box)

(iii) Enter Compliance Officer Details (example: yourself)

Add Your Partner(s) Information (example: you lot and your husband)

(4) Enter Your Business Code(due south). (Up to 3 simply)

(five) Make Payment: RM500 past credit card or online depository financial institution transfer

- You will and so receive an email – Approved (LLP is successfully registered) or Rejected (with reason and next course of actions).

Purchase LLP Documents

Login to MyLLP. Click "Purchase At present!". Enter LLP Name and Search. You can add the documents yous want to the shopping basket (Price is earlier GST). The documents are required for other applications such equally banking concern account, tax file, etc.

- Direct Annals LLP – Registration of LLP: RM5 or RM15 (certified copy)

- Certification of Registration: RM20

- Certificate of Skilful Standing: RM50

- LLP Electric current Profile: RM20

- etc

Y'all will receive an electronic mail that says "A production order has been received and processed. Please go to 'My Orders' on your Customer Portal workspace to download the referenced product. The product gild will exist available within 7 days from the date of product buy." Now y'all don't have to collect the documents at SSM, they will be automatically sent to your 'Orders' to be downloaded.

Note: There will be no notification that informs y'all the products are ready for download. So y'all take to check 'Workspace'->'Orders'. The products will be removed after 7 days.

I purchased the LLP Certificate and Profile, checked the Orders subsequently the purchase but could not see anything there. And so I called SSM after 7 days. After the eighth phone call (the person on the phone asked me to call another number), I finally got to the person in charge. This is the number: 03-2299 4744. She sent me the documents.

LLP Agreement

The limited liability partnership agreement shall be in the national language or

English linguistic communication, and shall consist of the post-obit particulars:

(a) the proper name of the limited liability partnership;

(b) the nature of business organisation of the limited liability partnership;

(c) the amount of capital contribution past each partner; and

(d) that the partners take agreed to become partners of the limited liability partnership

In the absence of an LLP agreement the 2d Schedule of the LLP Act 2012 shall utilize. (Search for 2d Schedule Clauses)

LLP Obligations

TAX FILE

- Annals a Taxation File for your LLP online at e-Daftar. (Tarikh Mula Akaun is the incorporation date. Tarikh Tutup Akaun is the Bookkeeping period end date. Y'all can leave the Maklumat Ejen Cukai blank if yous don't have one).

- You'll likewise need to submit a re-create of your LLP document.

- After the application, you will exist given income revenue enhancement no. PT xxxxx xxxxx (10 digit number)

Tax Approximate

- If you're an SME (less than RM 2.five one thousand thousand paid-up capital, and not related to a company > RM 2.5 one thousand thousand capital), yous don't need to fill up the tax estimate portion for the start ii years. Have to fill submit Form CP204 anyway, but leave sections 2 and six blank. Basis Menstruation (Tempoh Asas) is the business commencement date till the end of bookkeeping flow.

- Now CP204 form for Income Tax Approximate tin can be filled online: ez.hasil.gov.my (e-CP204). Info on How to utilise for ezHASIL Login.

EMPLOYEES

If you have employees, employ EPF within 7 days of hiring an employee and SOCSO within 30 days.

EMPLOYER'S FILE (Borang Daftar Majikan)

- All LLPs accept to register for an Employer's File which tin exist done online here: DaftarMajikan to go the E number in 3 days. My application got approved in 2 days. Partners are not considered as employees.

EMPLOYER'S RETURN Course (Borang Due east)

- Submit Employer'due south Render Forms (Borang E, example E-2018) by 31st March every year fifty-fifty you don't have whatever employees, starting from the following yr of LLP registration.

- Online: Co-ordinate to LHDN, LLP (PLT) tin fill out the Borang E online, Login to ez.hasil.gov.my. Select E-filing > e-Borang > e-E (The Borang Due east for the year volition only exist bachelor on 1st of March).

- For offline: To download the form go BorangMajikan. Select Borang Majikan and the year of tax.

Annual DECLARATION

- Annual Declaration can be done online AnnualDeclaration.

- First annual announcement needs to exist washed within xviii months from your LLP's registration appointment. For subsequent years, it needs to be done within xc days from the finish of your LLP's fiscal year. Example: Registration date: 12th July 2017.

- Fiscal year: 1st Jan – 31st Dec

- Starting time accounting period: 12th July 2017 – 31st Dec 2018

- First Almanac Declaration: 12th July 2017 + eighteen months = by 11th Dec 2018

- Hereafter Almanac Declaration: 31st December + 90 days = by end March every year

- Submission of Tax Declaration: 31st Dec + seven months = by cease July every year

Information required: Capital Contribution of each partner, enter 0 if no contribution.

Fiscal Year End, Financial indicators (in RM): Assets, Liabilities, Revenue, Profit/ Loss.

TAX Announcement

- Submit Within 7 months from the end of your accounting period. For example, 1st Jan to 31st Dec, y'all need to submit your tax declaration by end July.

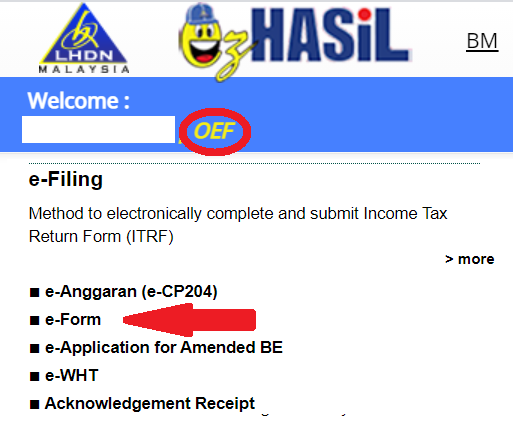

eastward-Filing

Tax filing can now be done online on ez.hasil.gov.my.

Awarding for LHDN ezHASIL Login

- Apply for ezHASIL Login Pin number/ digital certificate for your LLP for e-filing.

- For any inquiries y'all can transport you questions here: BorangMaklumBalas or use the HASILchat system on the ezHasil website

*The chat organisation disconnected and reconnected itself every 3 seconds, and occasionally the system logs itself out. I accept to restart the chat with another support person who would have to read the conversation history of my request. It was a desperate move as I sent an inquiry only no one answered it, sigh! For a department that collects taxation from us, if this is what it can offering, I am utterly underwhelmed.

Commencement Time Login and Tax Filing

They volition ship you an electronic mail with the OeF Pivot No. Then

- Log on at hasil.gov.my (ezHASIL website).

- Click First Time Login. Enter your PIN No. and Reference No.(Identification No.) to register your Digital Certificate.

- Click on Login. Enter your Reference No.(Identification No.) and password.

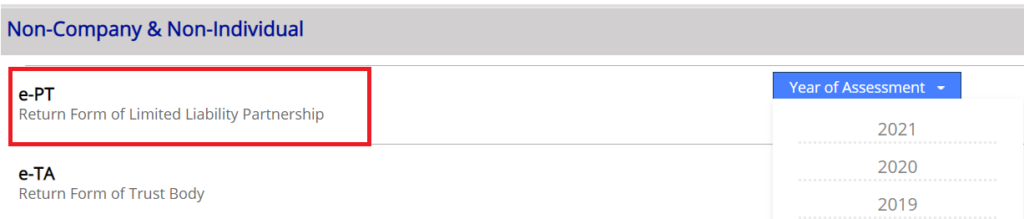

- Click on east-Forms (e-Borang) under e-Filing.

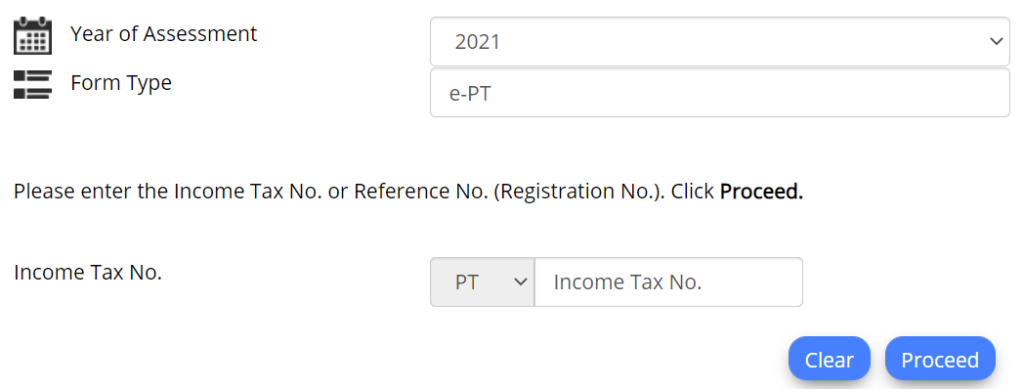

- Cull the required form and the year of assessment and click continue

- Enter your business organisation Income Revenue enhancement No. and Click Proceed

- Complete the grade and click Sign and Submit. Acknowledgement Receipt will appear. Please print and relieve the acknowledgement.

Manual procedure

submit Form PT 20xx (Malay version) to LHDN past mail service/hand to Bangi branch.

- Y'all can download the form BorangNyataTax – Borang: "Selain Syarikat & Selain Individu" and select year of revenue enhancement. Ringlet down to "Perkongsian Liabiliti Terhad".

- The English language version of PT20xx is for reference only and cannot be used for submission.

Tax Annunciation Terms

- Pendapatan Kasar (Gross Income)

- Pendapatan Larasan (Adapted Income/ Loss): Gross income minus commanded expenses

- Elaun Modal (Capital Allowance): Money spent on business assets such as car, machine, article of furniture, office equipment

- Pendapatan Berkanun (Statutory Income): Adjusted Income minus Majuscule Allowance

- Pendapatan Agregate (Agregate Income): if there are more than one businesses in the company, all the statutory income will exist accumulated

- Rugi Perniagaan Tahun Semasa (current year business loss) – Business Loss example: Belongings Loss – Physical damage to property, equipment example past fire. Liability loss – A business concern may be held liable for injuries suffered past an individual. Business premise renovation is capital expenditure not business loss.

- Pendapatan dikenakan cukai (Chargeable Income): Later on all adjustments are made, the company tax tin can be calculated from this corporeality

- Pelupusan aset (Asset disposal) is the deed of selling an asset normally a long term asset that has been depreciated over its lifespan like motorcar.

- Cukai pegangan (Withholding revenue enhancement or Retention tax) is an income revenue enhancement to be paid to the government by the payer of the income instead of the payee. The revenue enhancement is withheld or deducted from the income to be paid to the payee. For example, employment income.

- Tempoh asas (basis menstruum) is the period the partnership pays tax each yr and is usually the same as the bookkeeping period.

- Amaun diserap (amount captivated) – manufacturing costs (variable and stock-still overhead costs) that have been assigned to the units of goods produced instance: materials, direct labor, hire, and insurance

Current Bank Account for LLP

To open a depository financial institution account for your LLP: CIMB Current Account

Download the course here: CIMB Electric current Account for Business. Fill up the grade and get to the bank and submit the form physically.

Cimb Corporate Account Contact Number: 1300 888 828

Sources

*You lot tin can follow the steps described past Mr-Stingy

Source: https://www.therfiles.com/setting-up-limited-liability-partnership-llp-in-malaysia/

Posted by: parkthynand69.blogspot.com

0 Response to "How To Register Llp Online Malaysia"

Post a Comment